The Feedback Loop in Venture Capital that keeps a16z, Sequoia, and YC on top

Why only a few VCs consistently hit home-runs, or: How a VC's position in the syndicate network influences its performance, which in turn improves its network position.

This post is based on my masters thesis, you can find its full treatment of venture capital here.

Success in venture capital (VC) is about building great products and businesses, it's about understanding technology and markets deeply, but most importantly it's about knowing many of the right founders, investors and talents, and having access to the juiciest funding rounds. VC is a highly competitive industry that simultaneously would be impossible without extensive cooperation between its actors. Most investments into startups are done by syndicates of VC firms (>70% in the US according to Nguyen, Vu, 2021). Through this extensive use of syndication in VC lasting relationships develop over time which form a network of VC investors and firms that has a specific structure and is deeply influential in investment decisions and reciprocally tied to the entire process of venture capital.

The importance of being well-connected to the right people in venture capital

As I write in my thesis:

"In essence, venture capital is about the clever allocation of multiple types of resources: money, experience, guidance, know-how, talent, customers, suppliers, sources, information, contacts, access and opportunities. From a functional perspective, these resources are discovered, sourced, made available, channeled and applied via a complex network of professional relationships."

Thus, the structure of the network of syndicate relationships between VCs, and the position a general partner (GP) has in it, touches and influences every part of the process of investing in startups and helping those companies grow. Conversely, the success a GP has in that process improves their position in the network, setting them up for even better performance down the line. There is a direct relation, to the point of being treated almost equivalently in literature, between the reputation of a VC firm and the centrality and strength of its network position. Important literature like "Whom You Know Matters: Venture Capital Networks and Investment Performance" (Hochberg et al., 2007) has shown that VC firms with the best reputations, and network positions, consistently and significantly outperform competing VC firms with worse positions in the network of VC syndicate relationships. Literature, however, so far failed to provide a comprehensive, integrative explanation of how reputation ends up functionally influencing VC fund performance, as it either only finds correlations between high-level aspects (e.g. reputation and performance) or focuses on in-the-weeds details.

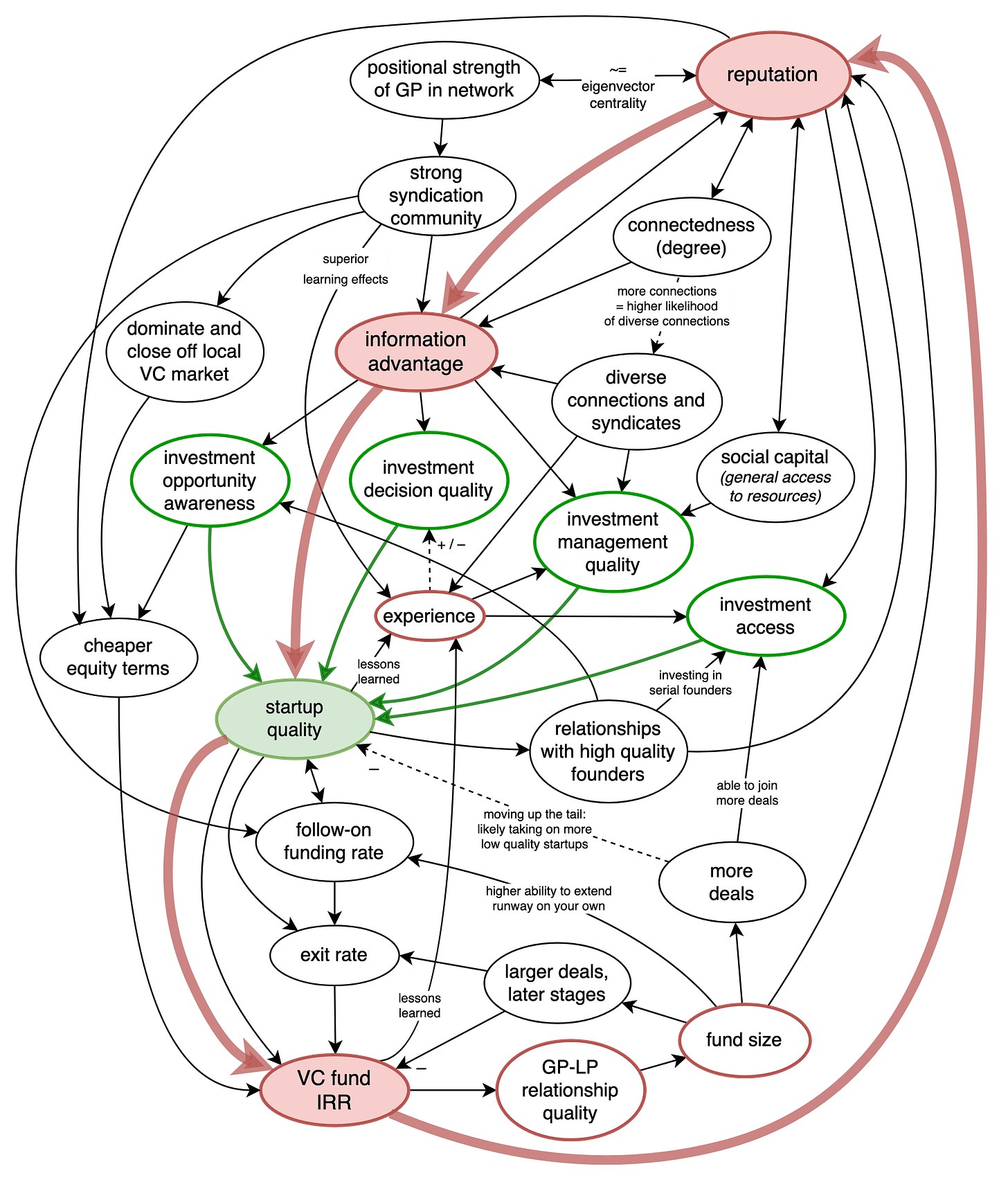

In this post today, I want to give an overview of exactly such a comprehensive, integrative explanation of the VC process and its interrelation with the syndication network, which I distilled from the current body of research on venture capital in my thesis. Given this explanatory model, it is then quite easy to understand the importance of network position in the VC process as well as the "central feedback loop of VC", as I call it, which leads to top funds like a16z, Sequoia, YC, and others to consistently outperform most others, causing a high barrier of entry for new firms and investors in the market.

To understand where my model is coming from, I'd like to shortly introduce the perspective of systems dynamics to help you frame how to think about the rest of this post.

Primer on systems dynamics

Systems dynamics, to me, is a way of thinking about and explaining the world. We want to understand high level outcomes and behaviors of a given topic, and for that we realize they are embedded in a larger system inside of which many different aspects are connected to each other in functional, causative relationships where feedback and control loops are frequently found. For this reason, we a priori reject intellectually lazy generalizations and aggregations, which are commonly made unthinkingly, since they fail to capture the true behavior of a systems as they gloss over real, even if tiny causative relationships that through iteration and emergence can come to dominate the macro level in which we ultimately are interested in. A natural way then to visualize a process in a system such as venture capital is to gather all elements, aspects and micro behaviors we can think of and start relating them to each other in terms of how they effect one another. In this way, I came up with the following explanatory model of the VC process and the importance of GP network position in it, where every causative relationship (every arrow) is based on findings in literature (full bibliography see here).

The explanatory model

This “causal loop diagram” (in systems dynamics lingo), or simply flowchart, highlights the main feedback loop of reputation leading to an information advantage, leading to picking and building better startups, leading to better returns and ultimately better reputation again.

Reputable VCs gain their information advantage via a wide, strong, and diverse network that is incentivized to share information and deals with them due to their high reputation, which for network partners is associated with great VC performance. The information advantage improve four different factors that lead to the VC having higher quality startups in their portfolio: investment opportunity awareness, investment decision quality, investment management quality and investment access.

Take a moment to go through the major elements of the flowchart and see if the causative relations resonate with you. Comment below or on X if you disagree or think I missed something important. For any detail on each connection, you can find it here.

Let me finish with some observations about VC which the above implies.

Power law of VC fund returns

I believe VC has many power law-like behaviors operating on different levels: talent-to-problem matching, iterative preferential allocation in capitalist systems between capital/resources/talent to profit opportunities which for startups either compound or fizzle out, and as I described self-reinforcing feedback loops between VC firms due the interrelation between syndicate network structures and venture performance. The only thing killing power law fund outcomes in VC, according to (Lahr, 2023), is buying too late stage, and especially selling too early. I generally agree with the implications of Lahr's analysis: If you truly have a power law outcome, why sell the entire stake at IPO instead of riding (some of) it for 20 more years? I explain more in the fund returns chapter of my thesis.

As I showed above, highly reputable VCs do not consistently outperform just because "they are famous" or "they are experienced" or "they have more capital than others". They outperform because their advantageous network position gives them resource access and thus makes them an attractive syndication partner which leads to the best information and the best opportunities flowing to them. VCs without a technical advantage, without a reputational/network advantage, without a personal connection advantage, simply cannot compete for access to the best founders since those founders generally get the most value from highly reputable VCs which via their superior resource, network, experience and talent access can help supercharge a great founders startup more than other VCs could, as long as they have bandwidth of course.

The implication for smaller and emerging VCs thus must be: get busy networking with the big boys or have an insanely correct, wildly contrarian understanding of your specific niche that allows for crazy outperformance which will catapult you to reputable status.